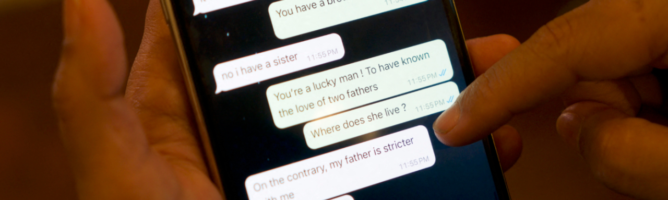

FBI warns seniors about billion-dollar scam draining retirement funds, expert says AI driving it

Date: August 25, 2025

A billion-dollar scam targeting seniors is growing rapidly, with fraudsters using artificial intelligence (AI) to manipulate victims into draining their retirement funds. The scam often involves fake investment opportunities or impersonation of trusted figures, including family members, to gain access to the victims' savings. The AI-driven aspect allows scammers to craft more convincing messages, making it harder for victims to detect fraud. The FBI has issued a warning, highlighting that seniors are particularly vulnerable to these scams, as many are not as familiar with modern technology or are easily swayed by convincing emails and phone calls. Experts stress the importance of heightened vigilance and encourage individuals to verify unsolicited requests for financial transfers, especially when it comes to retirement funds....

Read more