Fort Knox vs. Traditional Savings

The Future of Secure Savings

Fort Knox is the nation’s first High-Security Savings Account. It’s purpose-built to stop fraud, account takeovers and scam-driven transfers before money moves. If you value security over instant withdrawals, Fort Knox is designed for you. See how Fort Knox High-Security Savings Accounts compare to traditional savings accounts.

Savings Accounts

High-Security

High-Security Savings Accounts

up to 4.07% APY1

up to 4.07% APY1

Protect your life savings.

Experience the world’s first high-security savings account built from the ground up to keep your money safe and secure.

Questions about

Fort Knox?

Here are some of the more common questions we get about our High-Security Savings Accounts.

FAQ

Fort Knox is the world’s first High-Security Savings Account—an entirely new category designed for anyone who wants maximum protection for their savings. Built on a proprietary, patent-pending, Intelligent Closed-Loop™ Protection funds transfer architecture with industry-first account protections and enhanced by CLEAR®’s next-generation identity verification, Fort Knox fundamentally reimagines how banks protect customer assets. Unlike traditional accounts and apps that attempt to balance convenience with security, Fort Knox was built from the ground up to prioritize security at every level. Whether you’re saving for your future, protecting your family’s funds, or just want a smarter way to grow your money—Fort Knox is built to give you complete confidence in the security of your savings.

You can open a personal savings account right away. We’re also in the process of launching business savings accounts, which will be available to select industries and business types where we have extensive expertise. Stay tuned for more updates!

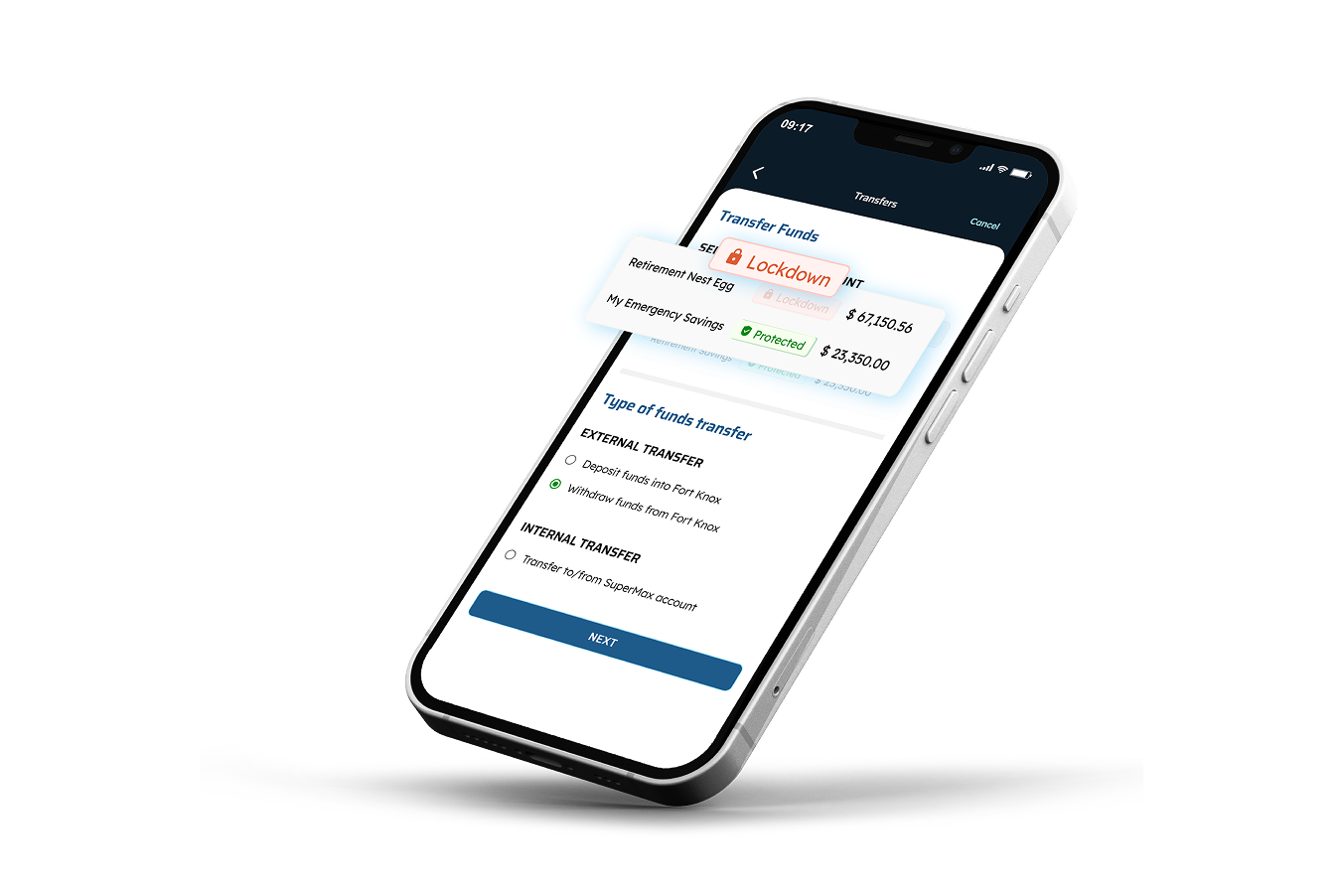

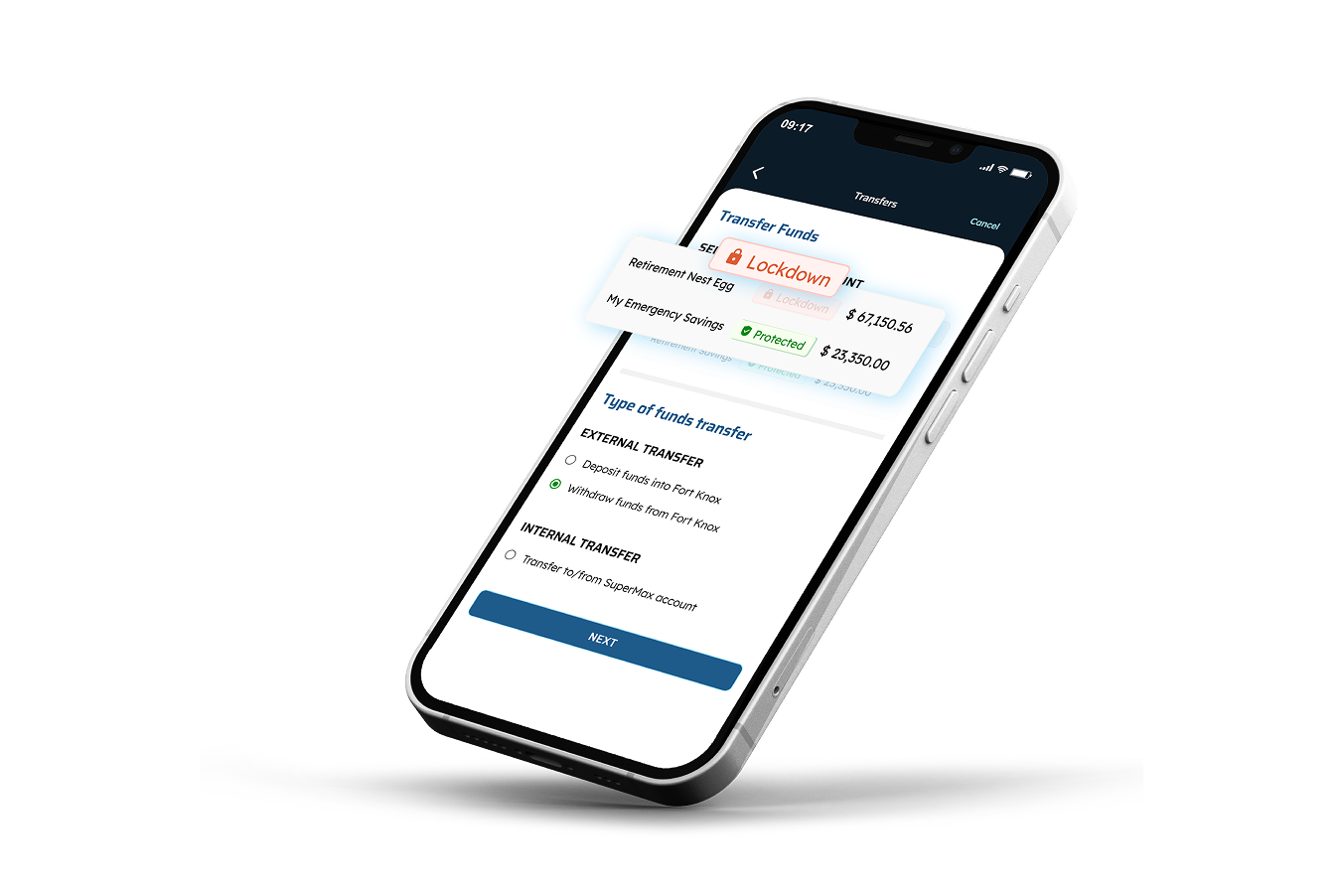

Fort Knox is fundamentally different than any savings account that exists today. Our proprietary patent-pending and industry-first Intelligent Closed-Loop™ Protection limits deposits and withdrawals to the same verified funding source. When your Fort Knox High-Security Savings Account is in Protected Status, the only place your money can go is back to where it came from. Fort Knox savings account numbers are restricted and incompatible with any external funds transfer system. If suspicious account activity is ever detected, your account automatically enters Lockdown™ Status, giving you the time and opportunity to review and verify the activity. Fort Knox contains multiple defined security zones from login to funds transfers. Within these zones, you can configure your own security measures with a Microsoft Authenticator soft token or a YubiKey physical token. And Fort Knox does not allow for instant withdrawals. Ever. Scams rely on speed to drain accounts before their victims notice, whereas every Fort Knox withdrawal remains pending for two days. Notifications will give you ample time to review the withdrawal request.

Yes. Your savings are FDIC insured up to $250,000. Subject to FDIC terms and conditions.

Yes, there’s a small monthly maintenance fee of $10/month—but it’s automatically waived when you keep a balance of $1,000 or more in your account. No hidden charges, and no surprises. We want your money to grow, not shrink from unnecessary fees.