Keep Your

Money Safe.

The World’s First High-Security Savings Account – Earn up to 4.07% APY1

Because your savings deserve more protection than a username, password and one-time code.

Fort Knox in the News

Whether you’ve ever fallen victim to fraud or not – and millions of Americans have – we all face it every day with scam texts, spoofed bank numbers, and countless phishing emails and phone calls. It only takes one mistake for your entire savings to be gone in minutes. That’s why we built Fort Knox.

Fundamentally different than any savings account that exists.

Fort Knox High-Security Savings Accounts are protected by Intelligent Closed-Loop™ Protection, which only allows transfers between your securely linked external bank account and your High-Security Fort Knox Account.

Industry-first Intelligent

Closed-Loop™ Protection.

Our proprietary patent-pending technology limits deposits and withdrawals to the same verified external funding source. In Protected™ Status, the only place your money can go is back to where it came from.

Active Account Cloak™

shields you from bad actors.

Fort Knox savings account numbers are never exposed to third parties or external payment systems. Additionally, Fort Knox account numbers are alphanumeric with special characters and are incompatible with any external funds transfer or payment system.

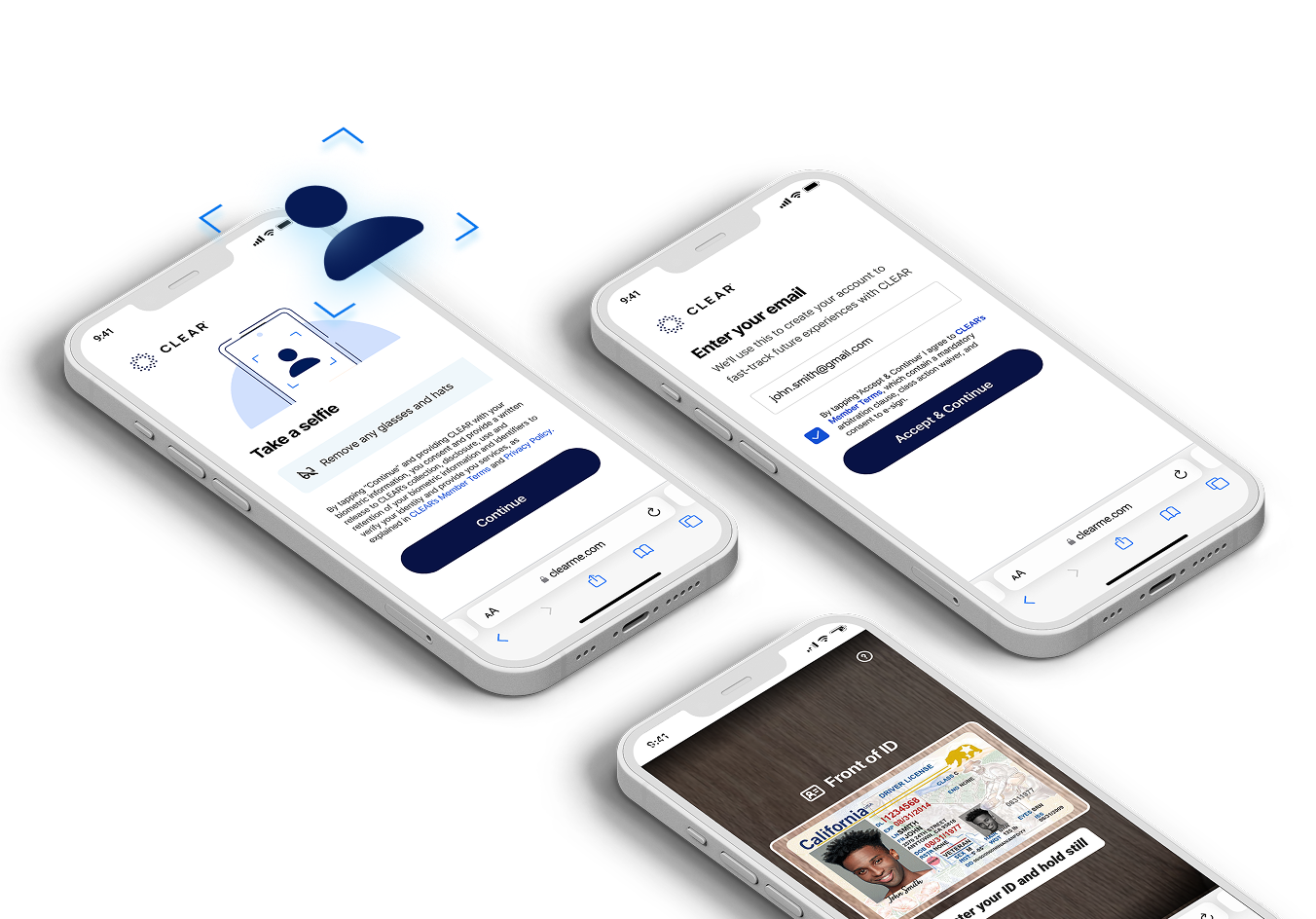

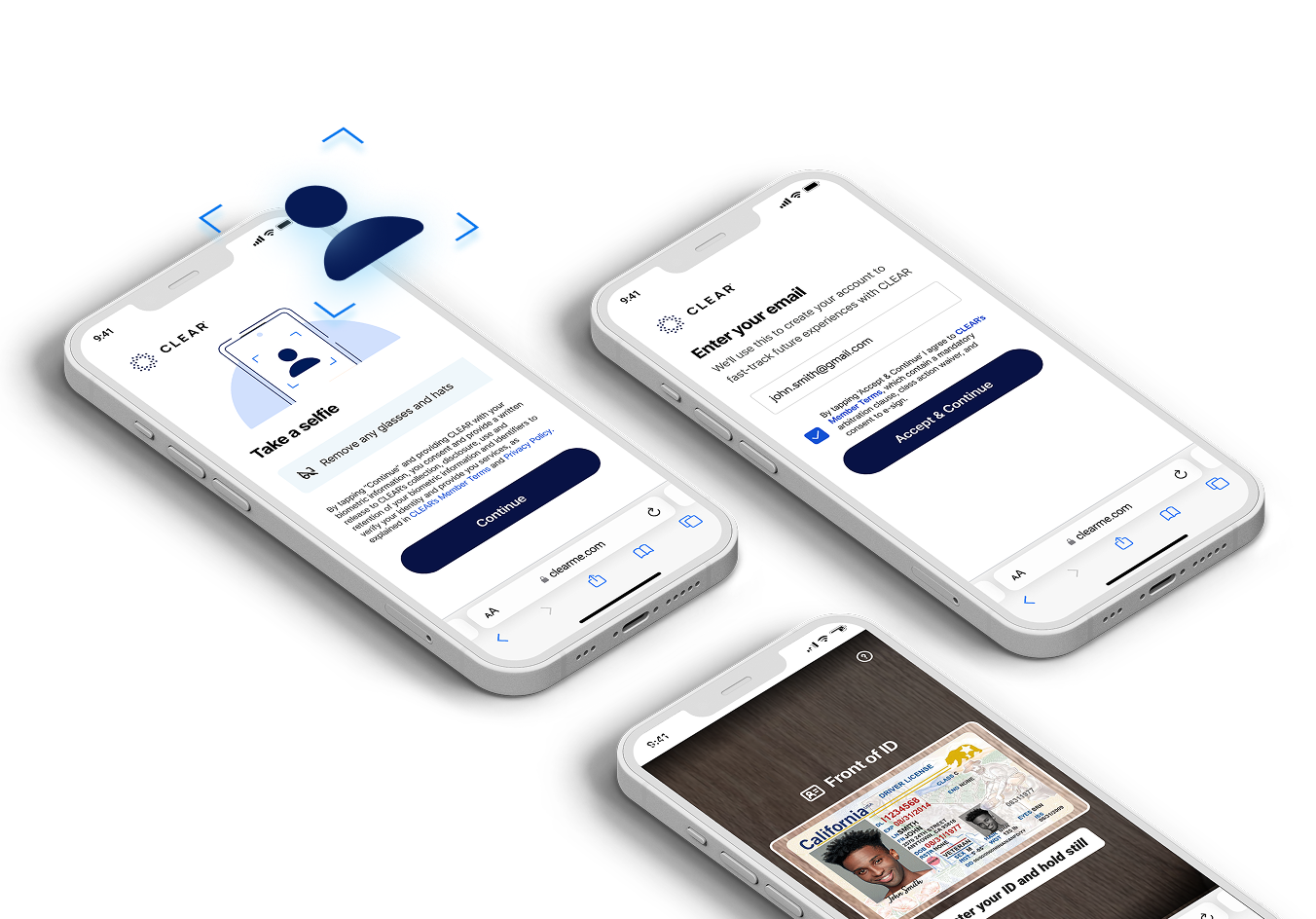

CLEAR® The Secure Identity Platform

No passwords to steal or guess. Fort Knox Bank leverages CLEAR®, the secure identity platform, to ensure only you can access your account—no passwords required.

Most banks prioritize speed over security. We don’t. We add intentional friction to transfer funds. We make it harder to access your savings on a whim.

Redefining Security in Banking.

In an era of increasingly sophisticated fraud attacks, traditional bank security is stuck in the password era. Fort Knox introduces an entirely new security architecture that stops unauthorized access before it starts.

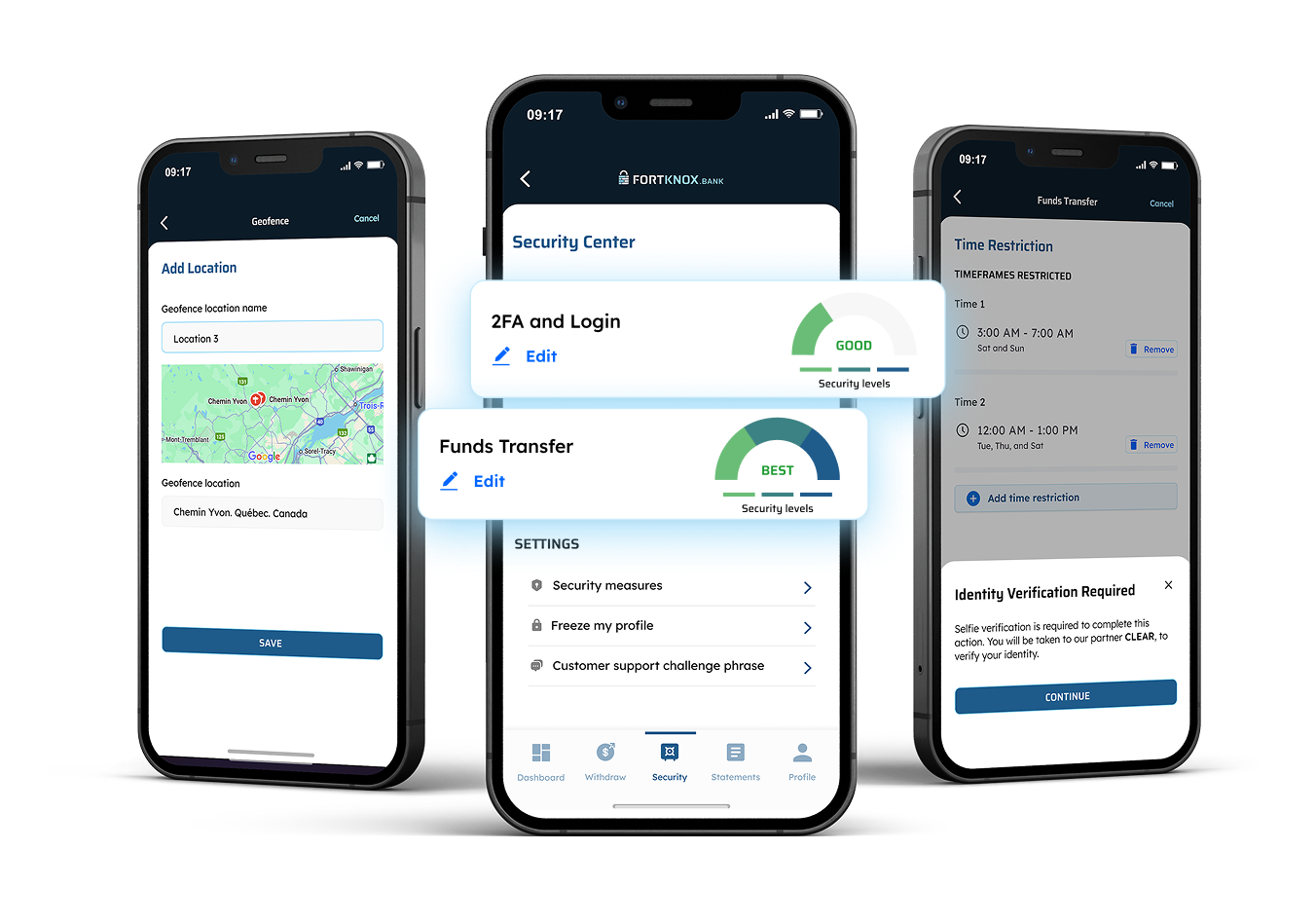

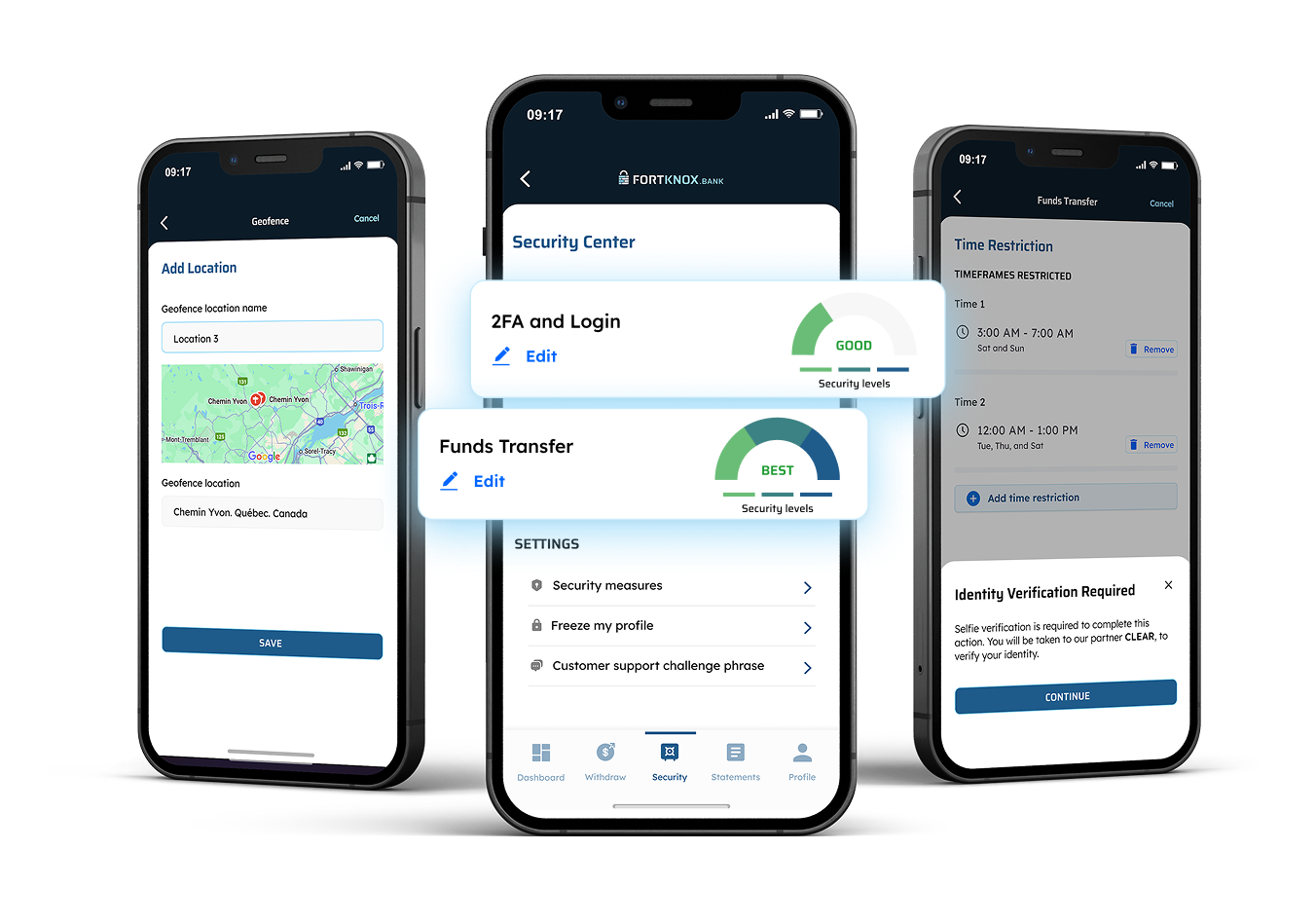

Customized Security Zones.

Fort Knox contains multiple defined security zones from login to funds transfers. Within these zones, you can configure your own security measures – for instance, requiring a Microsoft Authenticator soft token or a YubiKey physical token – and more.

Soft & Physical Tokens

Add powerful multi-factor protection to your savings. Fort Knox lets you require soft tokens like Microsoft® Authenticator or physical devices like a YubiKey® to approve withdrawals or access your account, keeping your funds secure even if your credentials are compromised.

Geofence Protection

Fort Knox protects your savings with location-based security. Set a trusted location — like your home or office — and withdrawals can only be authorized when your device is physically inside that area. Even if a scammer gains access to your account, they can’t move your money from anywhere else.

Time Restrictions

Take control of when your money moves. With Time Restrictions, you decide the exact days and hours withdrawals from your Fort Knox account are allowed. Outside those windows, all withdrawal attempts are automatically blocked — keeping your savings protected around the clock.

Suspicious activity?

Lockdown™ status activated.

If suspicious activity is detected, your account immediately enters Lockdown™ status—automatically freezing all incoming and outgoing transfers to protect your funds.

No Instant Withdrawals.

No instant withdrawals. Ever. Scams rely on speed to drain accounts before their victims notice, whereas every Fort Knox withdrawal remains pending for two business days allowing you ample time to review and confirm each transaction.

Next-generation banking leading with security.

Legacy platforms are constrained by decades-old core banking systems. Fort Knox represents a completely new approach to banking architecture, purpose-built for today’s security challenges.

No links. No QR codes. Ever.

No links or QR codes will be included in our transactional communication — these are the primary tools used in phishing scams for account takeovers.

If it’s not .Bank,

it’s not us.

Our .Bank domain confirms you’re on a verified and secure banking website — and not a lookalike fraud site. Only regulated banks that meet strict security standards are allowed to use a .Bank domain.

The Blacklist™.

Fort Knox has a proprietary Blacklist™ of payment apps, banks, credit unions and neobanks with excessive risk profiles that cannot be linked to a Fort Knox account for your protection.

Post-Quantum Encryption.

Fort Knox incorporates cutting-edge post-quantum cryptographic algorithms to safeguard account data from future quantum computing threats.

We’re an

FDIC-Insured Bank,

Not a Fintech.

Fort Knox is a division of Austin Capital Bank, a Federal Deposit Insurance Corporation (FDIC) insured independent community bank headquartered in Austin, Texas. As the bank behind Fort Knox, we’ve been recognized as a national leader in financial services technology, security, and innovation. Our banking platforms have over 1 million users nationwide.

Protect your life savings.

Experience the world’s first high-security savings account built from the ground up to keep your money safe and secure.

Questions about

Fort Knox?

Here are some of the more common questions we get about our High-Security Savings Accounts.

FAQ

Fort Knox is the world’s first High-Security Savings Account—an entirely new category designed for anyone who wants maximum protection for their savings. Built on a proprietary, patent-pending, Intelligent Closed-Loop™ Protection funds transfer architecture with industry-first account protections and enhanced by CLEAR®’s next-generation identity verification, Fort Knox fundamentally reimagines how banks protect customer assets. Unlike traditional accounts and apps that attempt to balance convenience with security, Fort Knox was built from the ground up to prioritize security at every level. Whether you’re saving for your future, protecting your family’s funds, or just want a smarter way to grow your money—Fort Knox is built to give you complete confidence in the security of your savings.

You can open a personal savings account right away. We’re also in the process of launching business savings accounts, which will be available to select industries and business types where we have extensive expertise. Stay tuned for more updates!

Fort Knox is fundamentally different than any savings account that exists today. Our proprietary patent-pending and industry-first Intelligent Closed-Loop™ Protection limits deposits and withdrawals to the same verified funding source. When your Fort Knox High-Security Savings Account is in Protected Status, the only place your money can go is back to where it came from. Fort Knox savings account numbers are restricted and incompatible with any external funds transfer system. If suspicious account activity is ever detected, your account automatically enters Lockdown™ Status, giving you the time and opportunity to review and verify the activity. Fort Knox contains multiple defined security zones from login to funds transfers. Within these zones, you can configure your own security measures with a Microsoft Authenticator soft token or a YubiKey physical token. And Fort Knox does not allow for instant withdrawals. Ever. Scams rely on speed to drain accounts before their victims notice, whereas every Fort Knox withdrawal remains pending for two days. Notifications will give you ample time to review the withdrawal request.

Yes. Your savings are FDIC insured up to $250,000. Subject to FDIC terms and conditions.

Yes, there’s a small monthly maintenance fee of $10/month—but it’s automatically waived when you keep a balance of $1,000 or more in your account. No hidden charges, and no surprises. We want your money to grow, not shrink from unnecessary fees.