Digital banking has made managing money easier than ever.

It’s also made stealing it easier than criminals could have imagined.

While October marks Cybersecurity Awareness Month, one threat stands out for the devastating financial toll it’s taking on American families: account takeover fraud.

The numbers tell a sobering story. Account takeover fraud losses reached $15.6 billion in 2024, up from $12.7 billion in 2023, according to research from the AARP and Javelin Strategy & Research. If you think this is someone else’s problem, consider this: 22% of U.S. adults experienced an account takeover in the past year. That equates to about 24 million households—roughly equivalent to every household in Texas, Florida and New York combined.

How criminals take over your accounts

Account takeover happens when criminals gain unauthorized access to your legitimate bank accounts using stolen credentials obtained through data breaches, phishing emails or credential stuffing attacks. The scale is staggering: Akamai’s 2024 Securing Apps report counted 26 billion web attacks every month.

Here’s why this works: 62% of Americans reuse passwords across multiple accounts, and 52% of login attempts involve leaked credentials, according to NordPass and Cloudflare. If criminals obtain your credentials from one breached website, they can try those same credentials on your bank account.

What makes account takeover particularly dangerous is that criminals use your actual credentials to access your account through normal banking channels. Your bank’s security systems see what looks like you logging in, maybe generating a text alert, but otherwise allowing access because the username and password are correct.

The personal cost

Individual victims lose an average of $12,000 per account takeover case. For many families, that represents months or years of savings wiped out in minutes.

But the financial damage is only part of the story. Reclaiming your compromised account means hours on the phone with your bank’s fraud department, filing police reports, disputing fraudulent transactions, changing passwords for dozens of accounts and monitoring your credit for months.

During recovery, you may not have access to your funds even after your bank agrees to reimburse you.

Your bank’s security wasn’t built for this

The security protecting your savings was designed decades ago for a world where bank fraud meant someone physically robbing a branch. Banks have tried to adapt by adding security layers, but criminals have proven adept at defeating these measures—and they’re only growing more sophisticated.

Most banks still rely on passwords and one-time codes sent via text. These methods have fundamental vulnerabilities. Passwords can be stolen or purchased. Text messages can be intercepted through SIM swapping, where criminals trick your phone carrier into transferring your number to a device they control.

Multi-factor authentication (MFA) is not foolproof. Sophisticated criminals bypass it through phishing attacks, social engineering or man-in-the-middle attacks that intercept your authentication in real time.

The deeper problem is architectural. Traditional banks prioritize speed and convenience. Once criminals defeat your password, they can drain your account and wire your money anywhere in the world within minutes. Proofpoint’s latest research shows that 99% of monitored organizations were targeted for account takeover attempts in 2024, and 62% experienced at least one successful incident.

“The entire banking industry has been obsessed with making it easier to move money. That includes making it easier for fraudsters. We built Fort Knox on the opposite principle: security first, convenience second. If your savings are important enough to protect, they’re important enough to add a few layers of friction.” — Erik Beguin, CEO, Austin Capital Bank

A different approach: Fort Knox high-security savings

What if your savings account was built from the ground up to remain protected even when criminals take over your checking account? That’s the premise behind Austin Capital Bank’s Fort Knox, the world’s first high-security savings account designed specifically to protect against fraud tactics devastating traditional banking.

“Most banks bolt security onto legacy systems designed 30 years ago. We asked a different question: What if we built a savings account from scratch with the sole purpose of making it impossible to steal money from? The answer was Fort Knox—closed-loop architecture that doesn’t just slow down fraud, it eliminates the attack vector entirely.” — Erik Beguin, CEO, Austin Capital Bank

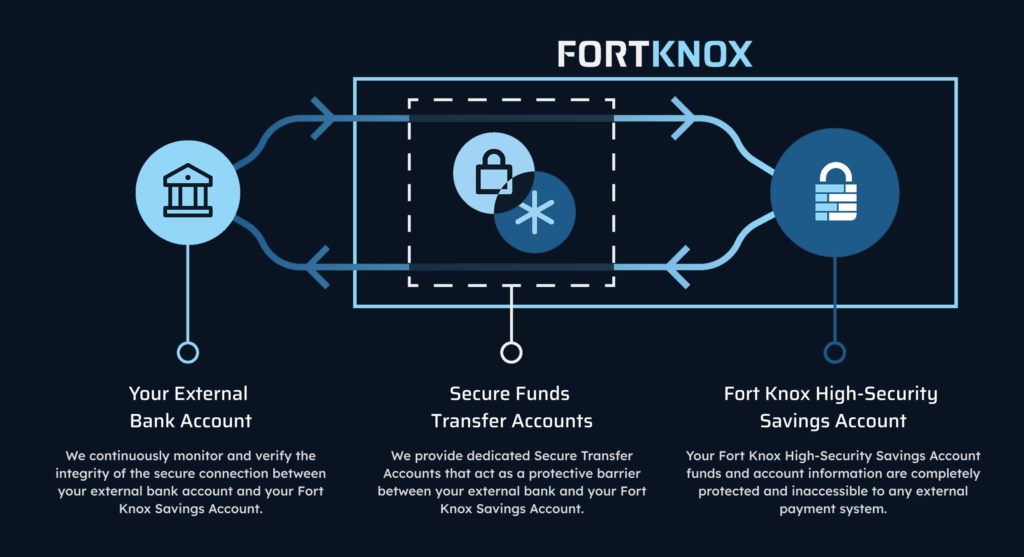

The core protection in Fort Knox is its proprietary closed-loop architecture. Your Fort Knox account can only be linked to a single verified external account—typically your existing checking account. Money can only move between these two accounts and nowhere else.

In traditional banking, when criminals take over your account, they have access to everything—your savings, P2P services like Zelle and more. Fort Knox breaks that vulnerability. Even if fraudsters compromise your checking account, your Fort Knox account remains isolated, safe and secure.

Fort Knox’s Account Cloak® allows you to deposit money into your account while concealing your actual account number and keeping it confidential. Fort Knox account numbers are alphanumeric with special characters and cannot be used with external payment systems—making them useless to fraudsters. For your protection, Fort Knox provides you with a unique Secure Deposit Number (SDN) — a dedicated account and routing number created just for deposits.

Opening an account requires proving you’re actually you

Fort Knox uses enterprise-grade identity verification to ensure only real people can open accounts. The system requires real-time biometric verification, including presenting your physical driver’s license and taking a selfie through the app.

“Passwords are the original sin of digital banking. Every data breach dumps millions more stolen credentials onto the dark web, and criminals just keep using them because banks keep accepting them. Fort Knox doesn’t use passwords at all. You can’t steal what doesn’t exist.” — Erik Beguin, CEO, Austin Capital Bank

Time is on your side

Unlike traditional savings accounts where criminals can wire your money anywhere instantly, Fort Knox requires a minimum two-day transfer window to move funds back to your linked checking account. This mandatory delay gives you time to notice something wrong and allows Austin Capital Bank’s fraud detection systems to analyze transactions and flag suspicious patterns before transfers are complete.

You control your security level

Fort Knox recognizes that everyone has different security needs. Set custom transfer limits, require additional verification steps or opt to use physical security tokens—like a YubiKey®, which must be plugged into your phone to verify your identity—or digital tokens like Microsoft Authenticator.

The security tradeoff is intentional

Fort Knox deliberately makes moving your money less convenient than traditional savings accounts. There’s no instant transfer option. You can’t link multiple external accounts.

This is by design.

Fort Knox exists to keep your savings safe, not to make transactions easy. Your checking account is where you keep money one to two months of expenses. Your Fort Knox account is where you keep savings you can’t afford to lose: your emergency or education fund, down payment savings and retirement reserves.

Protecting yourself in 2025 and beyond

Account takeover fraud is projected to reach $91 billion by 2028. You have options: accept the risks inherent in traditional banking or take measures to fight a fraud threat that grows ever more sophisticated.

Consider whether the security architecture of your current bank is strong enough, and evaluate whether a security-first approach like Fort Knox better matches the threats you face.

The criminals targeting your savings are sophisticated, well-funded and relentless. The question isn’t whether they’ll try to take over your accounts—it’s whether your bank’s security will stop them when they do.